Welcome to AurumDei

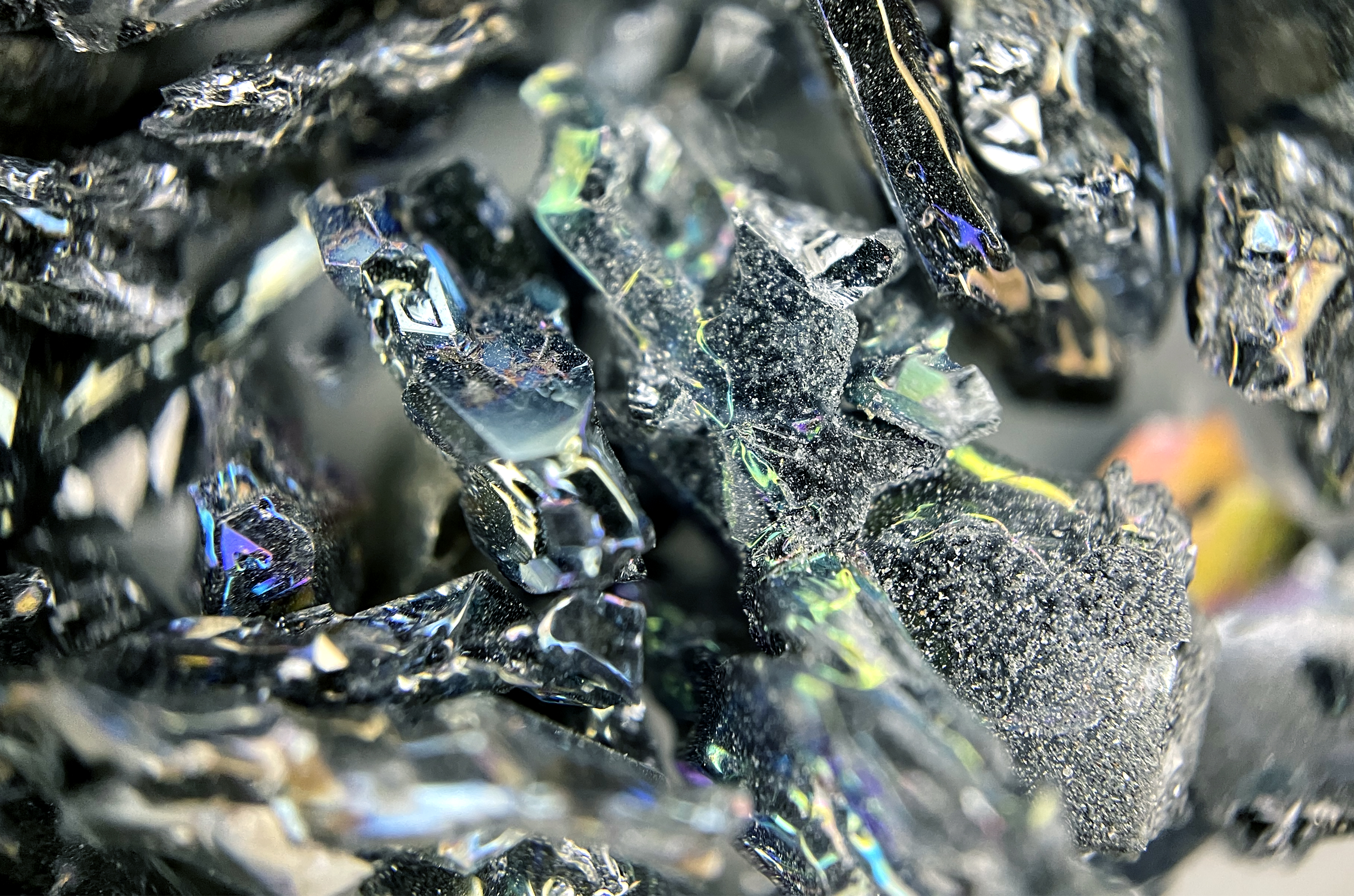

Own shares in tokenized mineral assets

Acquire fractional ownership via compliant tokens and receive distributions from project revenues. Access liquidity through peer-to-peer transfers and supported marketplaces.

Why AurumDei?

Real-World Asset Tokenization

We transform mining assets into blockchain-based digital tokens, enabling fractional ownership, liquidity, and global access all while respecting regulatory and geological standards.

Diversified Mineral Portfolio

Explore curated mineral projects in active gold mines, lithium-rich concessions, copper and rare earth developments across Africa, Latin America, and Asia.

Institutional-Grade Compliance

Our technical audits, financial models, and resource estimates are prepared by expert-verified Qualified Persons under NI 43‑101 or JORC frameworks.

Aligned Investor Economics

Token holders earn distributions tied to mine revenues, production milestones, and resource valuation upside—structuring for payouts even before extraction.

AURUM DEI

How we work

Governance & Compliance

Audited by Qualified Professionals

Geological and financial reporting led by firms compliant with NI 43‑101 and JORC codes.

KYC/AML-Verified

Investor onboarding ensures regulatory adherence across global jurisdictions.

Secure & Immutable Ledger

Token records are secured on a permissioned blockchain with real-time verification and tamper resistance.

Meet Our Team

Depths give miners

Senior Qualified Person with over two decades evaluating gold and lithium deposits globally.

call us on 899 000 999 88

jack@aurumdei.com

Mining engineer experienced in feasibility studies and economic modeling for resource projects.

call us on 899 000 999 88

amelia@aurumdei.com

Specialized in RWA tokenization, compliance, and facilitating institutional-grade access.

call us on 899 000 999 88

Alena@aurumdei.com

Frequently asked questions

A token representing ownership in a real-world asset like gold, lithium, or mining rights with enforceable value.

Through smart contracts, we disburse income from mine sales and operational profits directly to token holders proportionate to their holdings.

We require full environmental impact assessments, local community engagement plans, and regulatory approval from each jurisdiction before asset listing.